Win-win Strategy, Forex 2015

– Note: This is a very important article if you are wanting to set up your trading base for the rest of the year or start turning your Forex trading around with a new mindset. Make sure you have the time to give this lesson your 100% attention. Make yourself a coffee or cold drink and ensure you have 10 minutes of uninterrupted time to fully engage in what you are about to read. At the bottom of the article in the comments section I would love to hear what you want to achieve and what goals you have for your Forex trading in 2015. For now take your drink, get comfortable and enjoy! Often a lot of traders will be right on the verge of success with their trading, but they don’t know it.

How can you ever know how close you are too success until you actually get there – right? It is like when digging a hole for gold. You could dig for two weeks and stop, thinking that you are a mile away from the gold, when in reality you could be all but just one more dig of a shovel away for all you know and it could be that one more dig of the shovel that hits the gold vein and BAM – the gold starts flowing. And so it is for a lot of traders that it often happens that exactly same way.  cz/wp-content/uploads/sites/4/2015/09/ydFxJzr.png' alt='Binary options strategy pdf' title='Binary options strategy pdf'>

cz/wp-content/uploads/sites/4/2015/09/ydFxJzr.png' alt='Binary options strategy pdf' title='Binary options strategy pdf'>

Often with traders it is not a dig of a shovel, but a lightbulb moment where a trader understands or just ‘gets’ something where they previously did not fully comprehend it in the past and this watershed moment helps them in the future. This moment normally comes with something that a trader has battled with for a long time in their Forex trading until it just finally clicks and the trader has their ‘aha’ moment.

My forex strategy is suitable for busy people with lack of time. Strategy can beeasilyl tested on MT 4 chart with pencil and paper see for yourself. Max high of previous day marked by EMA 5 indicator. Click here to get the 10 Best Forex Strategies sent to you, starting now! #1: The Bladerunner Trade The Bladerunner is an exceptionally good EMA crossover strategy, suitable across all timeframes and currency pairs.

Traders will either persevere and continue digging until they become a success or they will quit not knowing whether they were just one more small shovel dig away or not, just like the picture of the man shows above turning and walking away just before he strikes it rich. In this article I am about to take you through some strategies and tips that you can use both right now and through this year to get your trading started off on the right foot and also so that you start digging in the right direction closer to your gold. Make This The Year You Stop System Hopping Pick your method, commit to it and then perfect it. The reasons traders don’t make money with the many different methods that they are continually jumping to is not because of the systems. It is because of what the trader is continually doing.

Because currency cross rates, by definition, do not include the U.S. Dollar, the most heavily traded cross-rate pairs do involve the second most commonly used currency, the euro. A cross exchange rate is mostly used when the currency pair being traded does not involve the US Dollar. The reason behind it is that conventionally if one wanted to convert a non-USD currency into another non-USD currency, the process requires you to convert it first to USD then converting the USD into the currency of preference. Foreign exchange rates of major world currencies. Compare key cross rates and currency exchange rates of U.S. Dollars, Euros, British Pounds, and others. Forex euro vs dollar.

It is the same mistakes that no matter what system the trader goes to mean that they will continually lose money. These are the mistakes such as overtrading, entering trades even when they know they shouldn’t and when they then lose money taking revenge trades to get the losses back which costs more losing trades. The other major mistakes that tend to be repeated time and again all revolve around emotions. For example; a trader has a few losses and instead of continuing to follow their plan and letting their trading edge play out, they begin to panic and worry. Instead of just continuing to trade the exact same setups like they should be, the trader moves away from their plan and starts trading different setups.

As soon as the trader does this, they may as well move to another system because the whole idea of having a trading edge is that the edge will work out over time, but for it to work out the trader needs to play the exact same setups time and again. For to work out it takes into account all the wins, losses, break evens and everything and has a profitable edge over all, but when a trader has a few losses and then stops playing the same types of setups they have just had losses on, they kill their edge. The flip side to this is when traders get really aggressive and confident and whilst this is good whilst it lasts, this can be a sure-fire way to blow an account. This normally starts with the trader on a roll and on a winning streak.

It then moves to the trader upping their risk levels because they get into the mindset of greed and thinking that with making so many winners they may as well make the most of it and risk more money right? Eventually and always the losses come and they do always come within a trading edge, but when the over-confident trader is trading they don’t factor in the losses. The problem for this trader is that they get really hurt and upset when they lose and want to quickly get that feeling back that they had of confidence and of being on a roll.

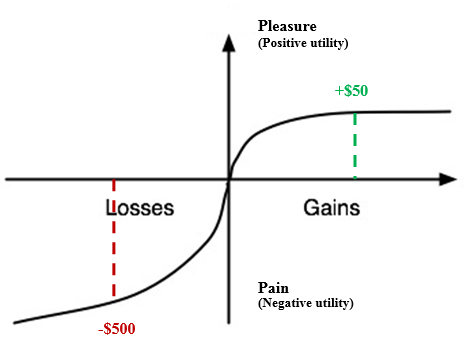

Win Win Strategy Photo

The problem is that it is gone and if they are not very, very careful so will large chunks of their account. These are just a few reasons why no matter what the method or system, traders have a lot more to learn than just a trading strategy of where to find a trigger signal on a chart. There are a lot of other reasons such as dealing with the uncertainty of the markets and having discipline. All of these things have nothing at all to do with a strategy, but have huge impacts on results and are why traders spend endless hours thinking it is the strategy that is the problem and is going to help them, when in fact it is themselves they need to work on if they want to find success. About binary options trading. When traders approach their trading from the mindset of the “I want to get rich now” and don’t want to put in the time or effort, they get out of it what they put in and that is what a lot of system hoppers get.