What Is The Range In Forex

Find support and resistance to define your range; As with any strategy manage your risk in the event of a breakout; Range trading is one of many viable trading strategies available to Forex traders. Home Forex Currencies Average Pip Movement Average Pip Movement This is the average pip movement of the major currency pairs in each major Forex Trading Session. Since the Forex market spends most of the time in consolidation having a range trading strategy is essential in order to survive in this business. Range scalping is not hard, however, you do need a high level of discipline and a strategy to determine when a trading range is in place. In the event the range have been decided: in your illustration the range is actually 1. 4950: it is possible to consider getting into and/or getting out trades for the certain foreign. After all, Range Bar Charts don't care about the noise so all we interested in are where the price can be after n-pips move So, let's say we have a 3-pip range bar chart, assuming the price of a bar opens at 0, and moves one pip up/down at a time (smallest unit is a whole pip). That means the there are only a finite list of possibilities for where the price could be at close of the bar.

Nicolellis bars were developed in the mid 1990s by Vicente Nicolellis, a Brazilian and who spent over a decade running a in Sao Paulo. The local markets at the time were very volatile, and Nicolellis became interested in developing a way to use the to his advantage.

He believed price movement was paramount to understanding and using volatility. Binary options trading strategies pdf. He developed Range Bars to take only price into consideration, thereby eliminating time from the equation. Nicolellis found that bars based on price only, and not time or other data, provided a new way of viewing and utilizing the volatility of the markets. Analysis binary options online. Today, Range Bars are the new kid on the block, and are gaining popularity as a tool that traders can use to interpret volatility and place well-timed trades.

What Is The Range In Exponential Functions

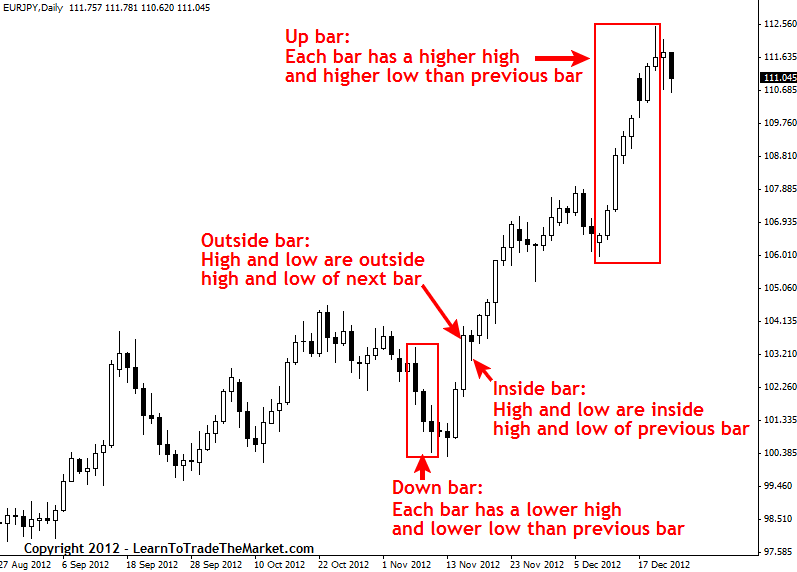

(For a primer on, check out the.) Calculating Range Bars Range bars take only price into consideration; therefore, each bar represents a specified movement of price. Traders and investors may be familiar with viewing bar charts based on time; for instance, a 30-minute chart where one bar shows the price activity for each 30-minute time period. Time-based charts, such as the 30-minute chart in this example, will always print the same number of bars during each, regardless of volatility, volume or any other factor. Range Bars, on the other hand, can have any number of bars printing during a trading session: during times of higher volatility, more bars will print; conversely, during periods of lower volatility, fewer bars will print. The number of range bars created during a trading session will also depend on the instrument being charted and the specified price movement of the range bar. Three rules of range bars: • Each range bar must have a high/low range that equals the specified range. strategies for trading binary options • Each range bar must open outside the high/low range of the previous bar.

As you can see in Figure 5, an upward trendline is drawn at the lows of an upward trend. You can now see how this trendline can be used by traders to estimate the point at which a currency pair will begin moving upwards. Trendlines can also be used in identifying trend reversals. Notice how the price is propped up by this level of support. how to cash forex trend Drawing a trendline is as simple as drawing a straight line that follows a general trend.

What Is A Forex Trader

• Each range bar must close at either its high or its low. Settings for Range Bars Specifying the degree of price movement for creating a range bar is not a one-size-fits-all process. Different trading instruments move in a variety of ways. For example, a higher priced stock such as Google (Nasdaq:) might have a daily range of seven dollars; a lower priced stock such as Research in Motion (Nasdaq:) might move only a percentage of that in a typical day. It is common for higher priced trading instruments to experience greater average daily price ranges. Figure 1 shows both Google and Research in Motion with 10 cent range bars.