Oil Trading Online Forex Chart

Best forex trading strategies on h1. Hi all, heiken ashi smoothed + bbstop this 2 indicator based system have veen born at forex tsd at.

Crude Oil is a naturally occurring fossil fuel. It is formed from ancient organic matter – such as plankton and algae – that has been buried underground and exposed to extreme heat and pressure. Crude is one of the world’s most in-demand commodities, because it can be separated or refined into various consumer, industrial and energy products. These include gasoline (petrol), diesel, lubricants, wax, and other petrochemicals, many of which are used to manufacture plastics. The composition (or ‘qualities’) of crude oil varies by source, but there are two main high-quality types that are used to benchmark global prices. Those standards are the United States’. Crude oil prices: a tale of supply and demand Like all commodities, the price of oil is heavily influenced by supply and demand.

Forex Trading Charts Online

As a consequence, many traders will attempt to estimate global production and consumption when predicting where oil prices will head. While global reserves of oil are limited and will eventually run out, there is currently enough that supply is largely dependent on how much countries are willing or able to drill. For this reason, a group of large oil-producing nations formed the Organisation for Petroleum Exporting Countries (OPEC) in 1960. /binary-option-auto-trade.html. This body sets production quotas for its members, with the aim of reducing competition and keeping prices at profitable levels. Prices are likely to fall if global oil production is increased – for example by OPEC, an independent country or other collaboration – and rise if output is reduced (assuming demand is static).

Anything that could affect a country’s ability to supply oil – for example a reduced production quota, war, terrorist attack or natural disaster – is therefore capable of having an effect on prices. Demand for oil, on the other hand, generally depends on overall global economic growth as the commodity has wide-ranging applications. Demand often increases during boom periods and falls when the world’s economy is performing poorly, with price following suit (assuming supply is static).

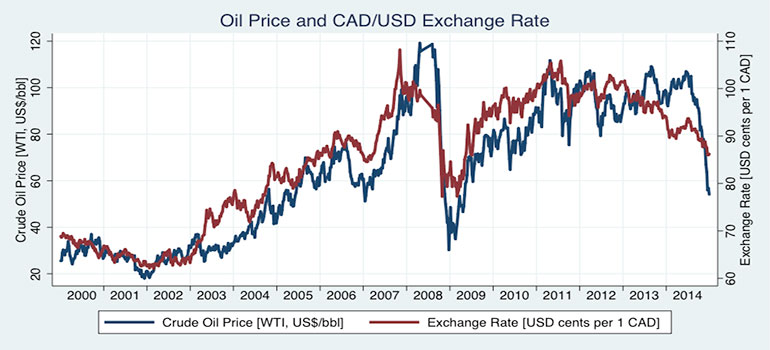

Oil is traditionally priced in US dollars so demand can also be influenced by the relative strength or weakness of this particular currency, even becoming more attractive as an investment when the dollar is weak. Demand for alternative resources such as renewables, which compete with oil in certain markets, can also have an effect. Oil price: recent history At the beginning of the century, global supply was predominantly determined by OPEC’s production, while global demand was led by the United States. These factors, paired with a rapid rise in Asian demand, led prices to surge from a cost per barrel of $25 for Brent and $27 for WTI in March 2001, to $140 for both grades by June 2008. binary options buddy 2.0 However, the last decade has seen technological advancements and deregulation facilitate increased US shale oil production, leading to a shift in the balance of global supply from OPEC to the US. Prices fell from $112 for Brent and $105 for WTI in June 2014, to under $36 for both by January 2016. OPEC responded by cooperating with several countries – including Russia – to implement broader ‘production quotas’ designed to stabilise prices. Olympic trade binary options 2017.