Average True Range Forex

Join other Individual Investors receiving FREE personalized market updates and research. Join other Institutional Investors receiving FREE personalized market updates and research.

Download: Download: Developed by Wilder, ATR gives Forex traders a feel of what the historical volatility was in order to prepare for trading in the actual market. Forex currency pairs that get lower ATR readings suggest lower market volatility, while currency pairs with higher ATR indicator readings require appropriate trading adjustments according to higher volatility. Wilder used the to smooth out the ATR indicator readings, so that ATR looks the way we know it: How to read ATR indicator During more volatile markets ATR moves up, during less volatile market ATR moves down.

When price bars are short, means there was little ground covered from high to low during the day, then Forex traders will see ATR indicator moving lower. If price bars begin to grow and become larger, representing a larger true range, ATR indicator line will rise. ATR indicator doesn't show a trend or a trend duration. How to trade with Average True Range (ATR) ATR standard settings - 14. Wilder used daily charts and 14-day ATR to explain the concept of Average Trading Range. The ATR (Average True Range) indicator helps to determine the average size of the daily trading range. In other words, it tells how volatile is the market and how much does it move from one point to another during the trading day.

ATR is not a leading indicator, means it does not send signals about market direction or duration, but it gauges one of the most important market parameter - price volatility. Forex Traders use Average True Range indicator to determine the best position for their trading Stop orders - such stops that with a help of ATR would correspond to the most actual market volatility. When the market is volatile, traders look for wider stops in order to avoid being stopped out of the trading by some random market noise. When the volatility is low, there is no reason to set wide stops; traders then focus on tighter stops in order to have better protections for their trading positions and accumulated profits. Let's take an example: EUR/USD and GBP/JPY pair.

Average True Range Stop Loss Forex

Question is: would you put the same distance Stop for both pairs? Probably not. It wouldn't be the best choice if you opt to risk 2% of the account in both cases. EUR/USD moves on average 120 pips a day while GBP/JPY makes 250-300 pips daily. Equal distance stops for both pairs just won't make sense.

In the table below you'll find many different currencies and their exchange rates against RUB. Exchange rate forex online chart ruble.

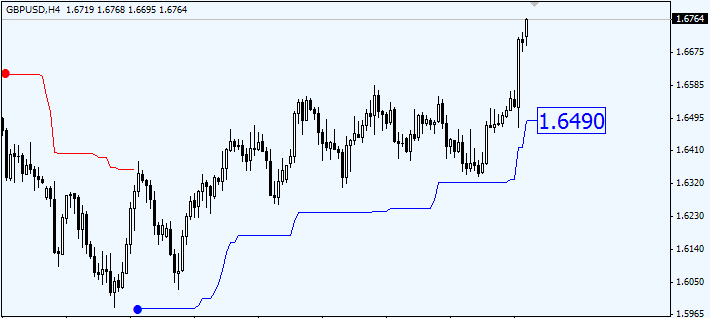

How to set stops with Average True Range (ATR) indicator Look at ATR values and set stops from 2 to 4 time ATR value. Let's look at the screen shot below. For example, if we enter Short trade on the last candle and choose to use 2 ATR stop, then we will take a current ATR value, which is 100, and multiply it by 2. 100 x 2 = 200 pips (A current Stop of 2 ATR) How to calculate Average True Range (ATR) Using a simple Range calculation was not efficient in analysing market volatility trends, thus Wilder smoothed out the True Range with a moving average and we've got an Average True Range. ATR is the moving average of the TR for the giving period (14 days by default).

True range is the largest value of the following three equations: 1. TR = H – L 2. TR = H – Cl 3. TR = Cl – L Where: TR - true range H - today's high L - today's low Cl - yesterday's close Normal days will be calculated according to the first equation. Days that open with an upward gap will be calculated with equation #2, where volatility of the day will be measured from the high to the previous close. Days which opened with a downward gap will be calculated using equation #3 by subtracting the previous close from the day's low. ATR method for filtering entries and avoiding price whipsaws ATR measures volatility, however by itself never produces buy or sell signals.

Download forex economic calendar on your desktop. Forex Economic Calendar Widget, Application Free Download Change the current settings ikili opsiyon gfm trader change the quotes rate widget. The forex widget is based on your current setting of the spreads table. The final economic calendar that will be shared is Forex Factory’s. Their calendar is by-far the best visually and by what data is displayed. You are able to print the calendar, filter events, and synchronize the time with your own!

It is a helping indicator for a well tuned trading system. For example, a trader has a breakout system that tells where to enter. Wouldn’t it be nice to know if the chances to profit are really high while possibility of whipsaw is really low? Yes, it would be very nice indeed. ATR indicator is widely used in many trading systems to gauge exactly that.

Average True Range Eur Cad Forex Factory

Let's take a breakout system that triggers an entry Buy order once market breaks above its previous day high. Let’s say this high was at 1.3000 for EURUSD.